- Personal

- Credit Cards

Credit Cards for You

Get more flexibility, more possibilities and faster checkouts with any of Arbor Financials’ contactless credit cards. Enjoy no annual fees, great rates, plus no balance transfer fees when you save money by bringing over higher-interest rate credit card balances.

What feature is most important to you?

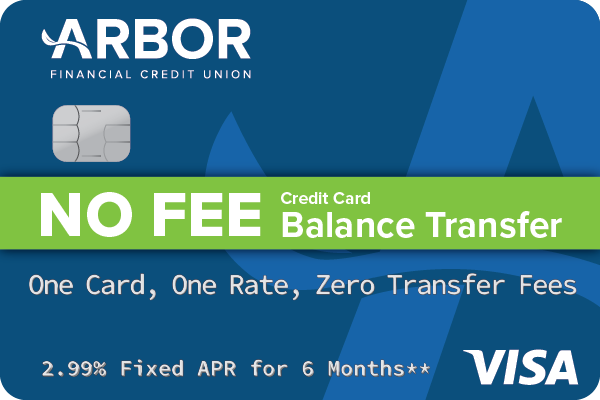

No FEE Credit Card Balance Transfer

One Card, One rate, Zero Transfer Fees!

Swap over your high-interest-rate credit card balances for a Visa Rewards Card or Advantage Card and save!

One Rate: Switch other balances over to Arbor for a low, fixed rate of just 2.99% APR** for 6 months

One Card: By consolidating your other credit card debt into one easy, fixed monthly payment, you can simplify life

Zero Transfer Fee: With NO transfer fees, you can pay less interest on your balance and pay off debt faster

Now is the time to transfer your balance and save. It's easy to get started, simply call 269.375.6702 to speak with one of our friendly lending experts and apply today! Already have an Arbor Credit Card, to get started, fill out the form below.

Rewards Credit Card

Earn Points for Cash Back, Merchandise, and Travel!

- Rates as low as 13.50% APR*

- Balance transfer offer: 2.99% for 6 months with no transfer fees

- Earn 2,500 points for activation.

Earn 500 points when you sign up for eStatements.

Earn Great Rewards:

- 3X Points on Restaurants & Travel up to $1,000 each billing cycle, and 1X thereafter.

- 2X Points on Groceries & Gas up to $1,000 each billing cycle, and 1X thereafter.

- 1X Points on Everything Else!

Enhanced Benefits

- Contactless Cards: Simply "Tap & Pay" for faster checkout at the register to enjoy convenience and safety.

- Card Information: Printed on the back of the card for added security.

- Chip Technology: Provides another level of encryption when you make purchases.

- Swap to Simplify & Save: Transfer over high interest rate credit card balances and save with a low, fixed rate of just 2.99% APR** for 6 months.

- Earn rewards on all your purchases.

All cards come with these great benefits. Apply today and start earning rewards on every purchase!

Advantage Credit Card

Save More With a Low-Rate Card

- Rates as low as 10.25% APR*

- Balance transfer offer: 2.99% for 6 months with no transfer fees**

- Sign up for eStatements and earn a $5 credit.

Enhanced Benefits

- Low APR: Save more with a low-rate card designed to help you manage your finances better.

- Contactless Cards: Simply "Tap & Pay" for faster checkout at the register to enjoy convenience and safety.

- Card Information: Printed on the back of the card for added security.

- Chip Technology: Provides another level of encryption when you make purchases.

- Swap to Simplify & Save: Transfer over high-interest rate credit card balances and save with a low, fixed rate of just 2.99% APR** for 6 months.

All cards come with these great benefits. Apply today!

Rewards Business Credit Card

High Credit Limit, Low Rates, Amazing Rewards

- Earn great rewards:

- 3X Points on Restaurants & Travel up to $1,000 each billing cycle, and 1X thereafter.

- 2X Points on Groceries & Gas up to $1,000 each billing cycle, and 1X thereafter.

- 1X Points on Everything Else!

-

- Use your CURewards points to get cash back, gift cards, merchandise and travel rewards when you make everyday purchases.

- Use your CURewards points to get cash back, gift cards, merchandise and travel rewards when you make everyday purchases.

- Get MORE security! Card information is printed on the back of the card, and chip technology adds another level of encryption when you make purchases.

- Simply "Tap & Pay" for faster checkout at the register to enjoy convenience and safety.

- All cards come with these great benefits.

Volt Rewards Credit Card

Build Credit While Earning Points - Designed for Volt Account Members aged 16-24.

- Rates as low as 13.50% APR*

- Earn great rewards:

- 3X Points on Restaurants & Travel up to $1,000 each billing cycle, and 1X thereafter.

- 2X Points on Groceries & Gas up to $1,000 each billing cycle, and 1X thereafter.

- 1X Points on Everything Else!

- Use your CURewards points to get cash back, gift cards, merchandise and travel rewards when you make everyday purchases.

- Earn 2,500 points for activation.

Earn 500 points when you sign up for eStatements. - Get MORE security! Card information is printed on the back of the card, and chip technology adds another level of encryption when you make purchases.

- Simply "Tap & Pay" for faster checkout at the register to enjoy convenience and safety.

- All cards come with these great benefits.

No Annual Fee

Enjoy significant cost savings and flexibility, perfect for those aiming to maximize their benefits.

Contactless Cards

Simply "Tap & Pay" at the register to enjoy convenience and safety. Plus, the advanced security features protect your information, giving you peace of mind with every purchase. Learn more about how contactless payments work.

Digital Wallet Options

Pay without the plastic; making purchases is easy, safe, and secure without having to swipe your card when you use your digital wallet. Learn more about the benefits of a digital wallet.

24-Hour Support

Get credit card assistance whenever you need it and enjoy peace of mind knowing you’re in good hands.

Visa's Zero Liability Policy1

Shop with confidence knowing you won’t be held responsible for unauthorized charges.

Lock Your Card for Safety

Manage your credit cards anytime, anywhere with Mobile & Online Banking.

Auto Rental Collision Damage Waiver

Get insurance coverage for automobile rentals made with your credit card.

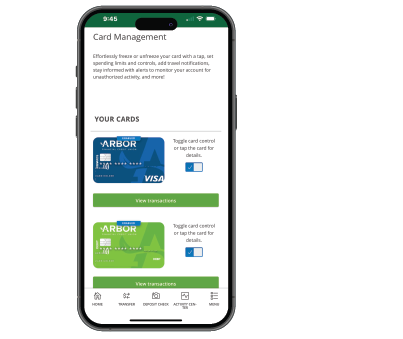

Manage your credit card through our Mobile & Online Banking App.

Manage your Arbor Financial credit cards anytime, anywhere! Enable real-time alerts, lock and unlock your card, and so much more. Now, when you are in your Arbor Mobile & Online Banking, click "Card Management" in the menu to access Card Controls and alerts easily and quickly.

Arbor Financial makes it easy to pay without swiping your card through these digital wallets:

Traveling with your debit or credit card?

Hit the road (or the skies) with confidence, because we work diligently to protect you no matter where you are in the world. Let us know before you head out on vacation to ensure uninterrupted use of your debit and credit cards. Out of state or international purchases may be flagged as potential fraud and consequently blocked until your authorization is confirmed.

It's easy. Set your travel alert using Mobile & Online Banking with your travel dates. Safe travels!

Get card assistance when you need it

Lost or Stolen Card

If your credit card is lost or stolen, call 866.591.2802 immediately.

Set Up Your PIN

If you would like to set up a PIN for ATM withdrawals on your credit card, call 888-886-0083 to set your PIN.

Online Banking

To access your credit card information online, please log in through Online Banking.

REMINDER: Your remittance address is P.O. Box 37603 Philadelphia, PA 19101-0603.

Personal Finance Resources

* Rates as of July 1, 2025. APR = Annual Percentage Rate. Rates are variable. Qualification is based on an assessment of individual creditworthiness and our underwriting standard. All Credit Union loan programs, rates, terms and conditions are subject to change at any time without notice. Not all applicants will qualify. Contact us for more information. See full disclosure.

** Annual Percentage Rate (APR). Offer available as of 7/1/25. Balance Transfer promotional rate applicable for 6 monthly billing cycles. Starting on the seventh month, the promotional rate will convert to your standard rate. Not eligible for CU Rewards Points and may not be used to pay other Arbor Financial accounts. Promotion, rate, terms and conditions subject to change without notice.

1. Visa’s Zero Liability Policy does not apply to certain commercial card and anonymous prepaid card transactions or transactions not processed by Visa. Cardholders must use care in protecting their card and notify their issuing financial institution immediately of any unauthorized use. Contact your issuer for more detail.