Wherever you look, it seems as though there are loan offers galore. Not only that, but offers for credit card balance transfers, pre-approvals, sales at every car dealership you can think of, and more.

And that’s great. Getting approved for that loan is easy as can be—if you have good credit. But what if you don’t?

FICO reports that the average American credit score is sitting at 704, up from 686 during the doldrums of the housing crisis a decade ago. But they add that the majority of new credit card customers have scores at 660 or below.

If your credit score is less than 600 you may feel like you have limited options. And while having bad credit isn’t an end-all when it comes to getting approved for a loan, it does mean that you’ll have to put in some work to improve your score and get back where you want to be.

So how do you do that? We spoke to one of our lending experts to get the answer.

Bad Things Happen to Good People

We talked to Consumer Lending Manager Ryan Taylor about what he sees with credit applicants and what tips he can offer people trying to fix their score.

What’s the biggest problem he sees leading to poor credit?

In many cases, Taylor says, something bad happened, either they had to tap into credit to help get them through, or they missed some payments and now they’re in debt and are struggling to build it back up again.

“They just don’t know how to build their credit score back up or get it to where it was before something bad happened to them.” he said.

“Whether they’re just trying to build their score up, they’re young borrowers and they’ve never had any credit before, or they’ve paid cash for everything and they’re now wanting to build up their score so they can finance a car, or a house, then that’s where (we) step in, to help them out,” Taylor said.

If you know where you’re at to begin with, then it can help you in setting goals for where you want to go.

“Some people know where they’re at and they know they need help, but they don’t know where to go; some people have no idea,” Taylor said.

That said, Taylor also took it upon himself to do a little myth-busting when it comes to credit and credit scores.

Busting Myths

Myth: If you have bad credit you can’t be approved for a loan or there’s nothing that can be done.

Reality: That’s simply not the case. “We’ll say, even to our members who think this exact thought, ‘bad things happen to good people.’ If they know they have bad credit, they know what’s on there, they know it’s on there for a reason, so we’ll get their credit pulled up, take a deep look at things, a couple uncomfortable conversations about what happened in the past and how they got to where they are, but we try to make it worth it for them, and try to either help them right away or give them an option or a plan to get them help in the future,” Taylor said. “They just need to be listened to, and we’re here to do that.”

With the right plan, and a little patience, the experts at Arbor Financial can help just about anyone improve their credit.

Myth: Bad credit is forever.

Reality: Taylor is here to tell you that this simply isn’t true. If you made mistakes in the past but have recently changed your ways, you’ll be rewarded for that. Following is how the credit rating agencies weight your behavior:

-

Current 12 months – 40%

-

Previous 13-24 months – 30%

-

Previous 25-36 months – 20%

-

Previous 37+ months – 10%

“Typically, most credit history stops recording from 7 to 10 years. Some items a little sooner, some items a little later,” he said. “Ten years is generally the max. Even bankruptcies, foreclosures, those can drop off after 7 or 8 years, so, time heals all wounds. After a certain amount of time, those things are just going to be all behind you.”

But of course it’s not enough to wait for the bad stuff to drop off, you have to be working on the other end as well.

“It really depends on where they’re starting off from, but in most cases, you can start seeing some pretty big increases in their score in 3 to 6 months,” Taylor said. “We’ll get them started off with a credit-building loan that will help them get some on-time payment history on their credit report…and then after 3-6 months of on-time payment history, we’ll extend some more credit out to them, whether it be increasing the amount we originally got them approved for, whether it be putting a credit card in their hands, which is going to be really beneficial to them; they may even be ready for a big purchase by that point. But it really depends on where they start.”

Myth: You should close out credit cards once you have paid them off.

Reality: Closing your credit card account could decrease your credit score because it affects your credit utilization, or borrowing capacity. “When you pay a credit card down to zero, which is a wonderful thing, what you may want to consider doing is cutting it up to prevent you from using it, but you definitely don’t want to close it out. Say you have a limit of $1,000 if you close it you’ve lost $1,000 of your total borrowing power, which will lower your credit utilization ratio, or capacity to borrow. The only time I would ever cancel a card is if there’s a monthly or annual fee, and you’re not using it.” he said.

Another good reason to keep the card open is because of the history associated with the card. The longer you’ve had credit available to you the better.

Building Up Your Credit Score

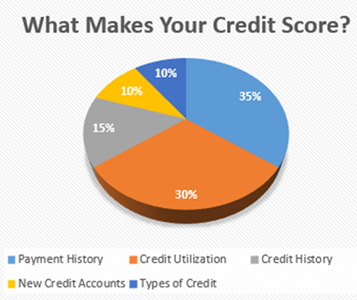

So what are the keys to make up your credit score? The two biggest ones are Payment History and Credit Utilization.

So what are the keys to make up your credit score? The two biggest ones are Payment History and Credit Utilization.

-

Payment history is one of the most important factors making up a full 35% of your credit score. Lenders want to know if you have a history of making your payments on time. If you’re having a difficult time making your payments, talk to someone about it, and see what your options might be.

-

Credit utilization referred to as simply “amount owed” makes up 30% of your credit score. The credit utilization ratio is a way of determining this, and it’s used to determine about how much of the total credit extended to you that you’re using. Keeping credit card and other loan balances low, 30% or lower is recommended, relative to your limit. So, if you have a credit card with a maximum credit limit of $5,000 you should keep your outstanding charges to less than $1,500.

-

Length of your credit history makes up another 15% of your credit score. The longer you’ve had credit available to you the better.

-

Number of new credit accounts equates for another 10% of your score. This includes new credit cards and recent inquiries into your credit history. Opening a new credit card decreases the average age of your credit history.

-

Types of credit rounds out the remaining 10% of your score. Credit rating agencies like to see a balanced mix of credit from installment loans (car or personal loans), mortgage, credit cards and retail accounts.

“If you can manage your payments and make on-time payments and also manage your capacity or your credit cards (don't max them out), it’s almost impossible for you to have a bad score. If you put those two numbers together, it makes up 65% of your credit score,” Taylor said.

The Next Step

No matter where your credit score is, if you want it to be better, Arbor Financial has experts like Ryan Taylor who can help you do just that.

“With a little guidance and plan implementation, I can pretty much promise that we’re going to get them into a better spot than when we first spoke,” Taylor said.

In addition to all the help that our experts can offer, we also have resources that you can take advantage of yourself. For instance, we offer a free Credit Score guide on our website, which explains what your credit score is and why it’s important, things that affect it, strategies for using credit cards appropriately, and more.

In addition, we also offer a free credit checkup to members, designed to help them find opportunities to save money, improve their credit score, and answer any and all questions they may have. It also features a complimentary credit report and FICO credit score, so you’ll know where you stand.

Improving rough credit can be daunting, but it doesn’t have to be impossible. With the experts from Arbor Financial at your side, we can help you make sure your credit is right where you want it.